Have you prepared a Will?

When it comes to estate planning, one of the most important things you can do is prepare a Will. A Will allows you to specify how you want your assets to be distributed after you pass away. Without a Will, your assets will be distributed according to your state's laws of intestate succession, which may not be in line with your wishes.

Preparing a Will may seem like a daunting task, but it doesn't have to be. If you have a relatively small estate, you can probably prepare a Will on your own using one of the many do-it-yourself Will kits available. However, if you have a more complex estate, you may want to consider working with an attorney to ensure that your Will is properly executed.

No matter how simple or complex your estate may be, it's important to take the time to prepare a Will. By doing so, you can ensure that your assets are distributed according to your wishes and not the laws of intestate succession.

How to Prepare a Will

It's important to have a will, especially if you have assets or children. A will allows you to control what happens to your belongings and your children after you die. You can also use a will to appoint someone to manage your estate and carry out your wishes.

There are a few things to keep in mind when preparing a will:

- Make sure you are of legal age. In most states, you must be 18 years old to make a will.

- Make sure the will is witnessed by two people who are not related to you.

- Make sure the will is notarized. This is not required in all states, but it can help to ensure the will is valid.

- Keep the will in a safe place, such as a safe deposit box.

If you have any questions about preparing a will, you should consult an attorney.

The Benefits of Preparing a Will

Once you have a will in place, you can rest assured knowing that your wishes will be carried out.

There are many benefits to preparing a will, including:

- Peace of mind: Knowing that your affairs are in order and that your loved ones will be taken care of according to your wishes can provide great peace of mind.

- Avoiding conflict: If you don't have a will, your loved ones may have to argue over who gets what. This can cause lasting damage to relationships.

- Protecting your assets: A will can help ensure that your assets are distributed the way you want them to be. For example, if you have young children, you can use a will to appoint a guardian for them.

- Minimizing taxes and expenses: With a will in place, your estate can avoid probate, which is a costly and time-consuming process.

If you don't have a will, now is the time to get one. It's one of the best things you can do for yourself and your loved ones.

What Happens if You Die Without a Will?

If you die without a will, it's called "dying intestacy". When this happens, state laws determine how your property will be distributed. If you have children, state laws will also determine who will raise them.

The laws governing intestate succession vary from state to state, but there are some general principles that apply in most states. First, your spouse will usually inherit all or most of your property. If you have children, they will inherit your property in equal shares.

If you die without a will and you are not married, your property will be distributed to your closest relatives. In most states, this will be your children. If you don't have any children, your property will go to your parents or your siblings.

The laws governing intestate succession are designed to protect your closest relatives. However, these laws may not reflect your wishes. For example, you may want to leave your property to charity or to someone who is not related to you. If you die without a will, your property will be distributed according to state law, not according to your wishes.

A will gives you the opportunity to express your wishes regarding the distribution of your property and the care of your minor children. If you die without a will, you give up control over what happens to your property and your children.

Don't take the chance that your property will be distributed according to state law rather than according to your wishes. Make sure you have a valid will that expresses your desires.

How to Make Sure Your Will is Valid

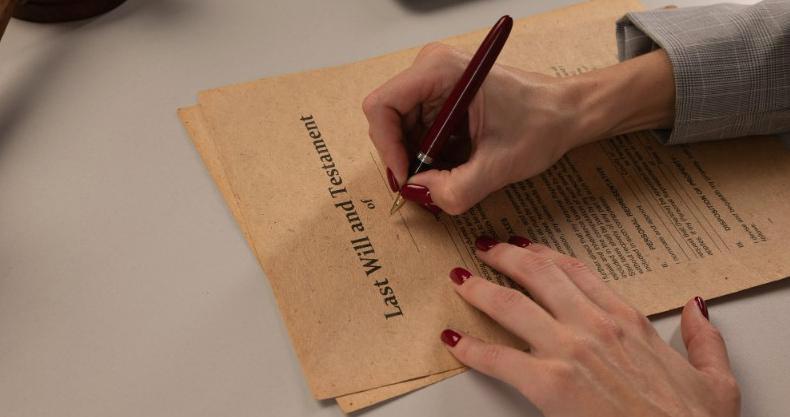

It is important to have a valid will in order to ensure that your final wishes are carried out. There are a few things to keep in mind when creating your will to make sure it is legal and binding.

First, your will must be in writing. You cannot simply verbalize your wishes to your family or friends. This written document will be the only record of your final wishes, so make sure it is clear and concise.

Second, you must sign your will in the presence of two witnesses. These witnesses must be adults who are not related to you or named in your will. They will need to sign the will as well, attesting to the fact that they witnessed you signing it.

Finally, it is a good idea to review your will periodically to make sure it still accurately reflects your wishes. If you have any major life changes (marriage, divorce, birth of a child, etc.), you should update your will accordingly.

By following these simple tips, you can ensure that your will is legal and binding. This will give you peace of mind knowing that your final wishes will be carried out exactly as you intended.

How to Choose a Executor for Your Will

One of the most important decisions you will make when drafting your will is choosing your executor. This is the person who will be responsible for ensuring that your final wishes are carried out, so it is important to choose someone you trust implicitly. Here are a few tips on how to choose a executor for your will.

First and foremost, you should choose someone who is organized and detail oriented. This person will need to be able to keep track of your assets and handle all of the paperwork involved in probate. They should also be levelheaded and able to make difficult decisions, as they may be called upon to do so.

You should also choose someone who is financially responsible and has a good head for numbers. This person will need to be able to manage your finances and pay your debts out of your estate. They should also be familiar with the tax code, as they will be responsible for filing your final tax return.

Finally, you should choose someone who you know will act in your best interests and carry out your wishes to the best of their ability. This person will be tasked with a great responsibility, so you need to be sure that you can trust them implicitly.

If you are having trouble choosing a executor for your will, you may want to consider talking to an attorney. They can help you identify the best possible candidate for the job and draft your will accordingly.